Designing Chime's 1st Cross-Functional Case Management Tool

Chime

•

9 months

Context

Rapid growth pushed Chime’s risk and support teams to rely on makeshift workflows—spreadsheets, tickets, and external tools—to manage increasingly complex, regulated casework.

Over time, the company accumulated 10+ tools performing the same functions—driving more than $5M per year on average in combined subscription spend and compliance-related fines.

Problem

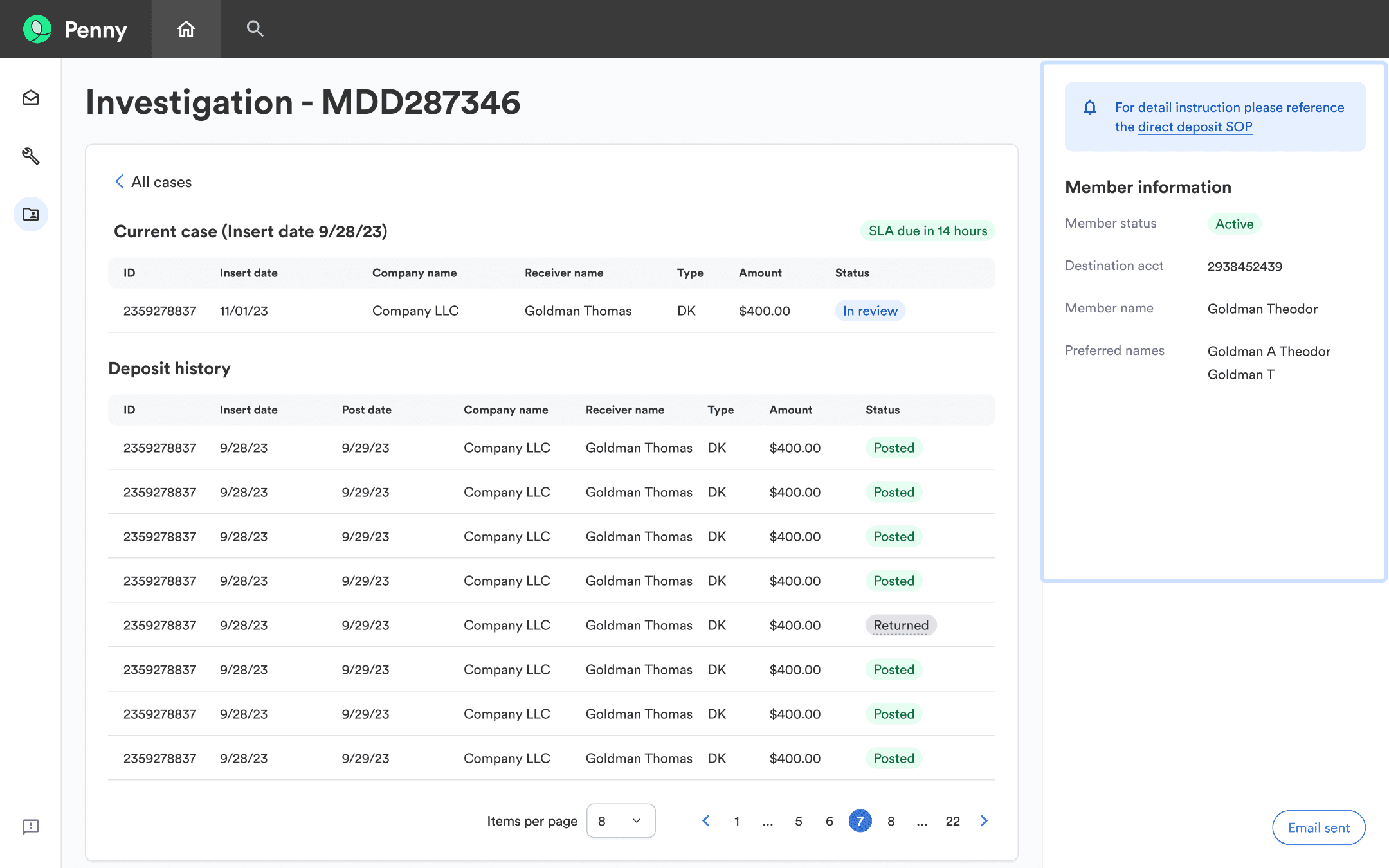

No centralized system existed to assign, prioritize, or track cases through completion.

We started with the Direct Deposit team for MVP as a simple but critical use case. They were responsible for reviewing first-time deposits, verifying member identity, and flagging suspicious activity—yet they were managing this high-risk work through spreadsheets, Slack messages, and PowerBI dashboards.

As Chime scaled toward millions of members, these fragile workflows began to break down, leading to missed SLAs, processing errors, regulatory fines, and an increasing number of member complaints.

Delays in accessing funds eroded member confidence at a critical moment, while repeated compliance issues strained trust with regulatory partners and increased scrutiny from agencies like the CFPB.

SUPPORT AGENT DESKTOP

Conceptual visualization created for this case study via Nano Banana Pro AI. Not an actual representation of Chime systems or agent workflows.

Goal

Create a scalable case management MVP that:

Enables agents to meet review SLAs for unverified deposits

Integrates with Chime’s main internal member data platform (the source of truth)

Is extensible — allowing other Risk & Support functions to use the same framework without rebuilding

Provides auditability and consistent workflows to reduce regulatory exposure

OUR MVP WOULD NEED TO SCALE ACROSS ALL RISK & SUPPORT OPERATIONS

Conceptual visualization created for this case study via Nano Banana Pro AI. Not an actual representation of Chime systems or agent workflows.

Process

I gathered extensive data from across agents, leads and cross-functional partners to understand the current state & begin visualizing the ideal state.

Research methods

Live agent shadowing

Sat with Direct Deposit agents during live case reviews to observe how they prioritized work, switched tools, and handled edge cases. Helped surface hidden workarounds, cognitive load, and moments where errors were most likely.

Team lead interviews

Conducted semi-structured interviews with team leads, risk managers, and compliance partners to understand SLA requirements, audit needs, and failure points. Ensured the design balanced usability with regulatory constraints.

Artifact review

Analyzed spreadsheets, Slack threads, tickets, and PowerBI dashboards agents relied on. Helped identify what information was critical vs. noise.

Journey mapping

Mapped the end-to-end case lifecycle from intake to resolution, including handoffs and escalations. Highlighted bottlenecks, duplicate effort, and unclear ownership.

Solution

A centralized case management MVP converting Chime's strong internal branding to a completely new tool with intuitive UX.

Agents can now work from a unified queue

We eliminated 5+ external tools for a singular tool with integration across all sources of direct deposit data and automated case assignment and SLA tracking.

They can access member context instantly

We provided in-context access to member data and historical activity via dynamic side and bottom panels, reducing context switching and cognitive load for agents.

They can view follow-ups or escalate when needed

We transformed informal escalations and processes into a clear, predictable in-product experience that guarantees speed and quality for every case while providing a clearer and more intuitive flow for agents.

Impact

The new case management platform reduced risk, improved efficiency, lowered cost, and built a scalable foundation for future growth.

+0%

+0%

Cases accurately resolved within SLA

+0 points

+0 points

Support NPS

$0

$0

Annualized cost savings

Reflections

What I learned

Systems thinking

I learned to think holistically and design for the whole system, not just one team. It takes longer and is harder, but ensures the design and feature will scale in the future.

Simplifying complexity

I learned that quality matters more than speed. Making information easier to find and workflows easier to follow reduced mistakes, helped agents work more confidently and save the company money.

Collaboration

I had to work across the entire risk and support org which entailed so many teams. I learned to get buy-in and maintain alignment from a large group of stakeholders in the context of a large, longer-term project.

Next Steps

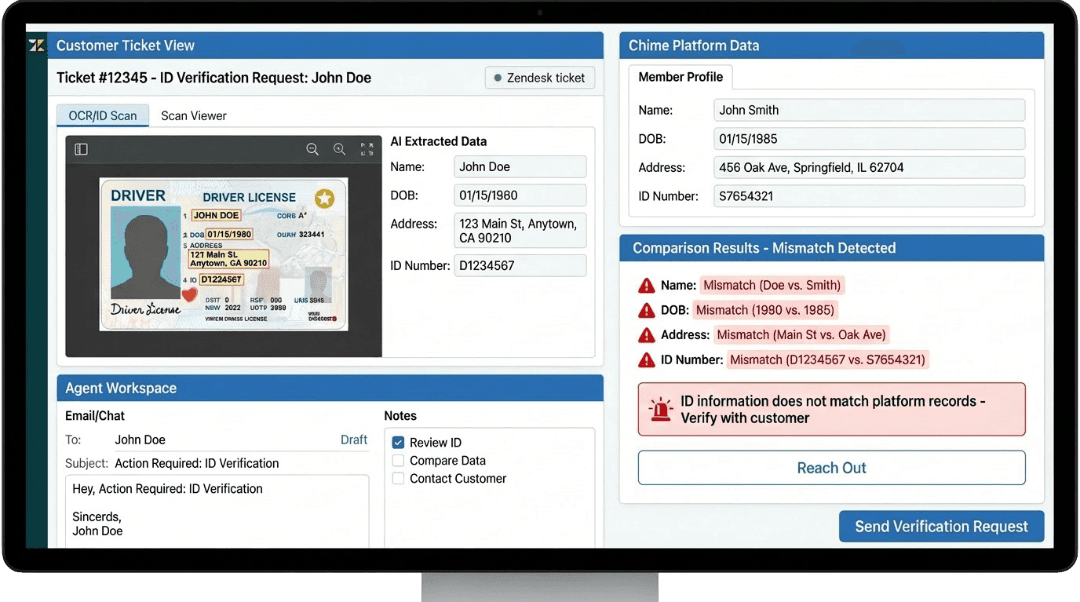

To reduce manual effort, the next iteration would introduce AI-powered document scanning and OCR (optical character recognition) to automate identity verification. This would shift agents away from repetitive checks and toward reviewing only cases that failed or required additional scrutiny.

AI/OCR Auto-ID Verification

Conceptual image created with Nano Banana Pro AI